As a startup, keeping track of your finances is crucial to your success. Accounting software can help you manage your finances more efficiently, saving you time and money. With so many options available, it can be overwhelming to choose the right accounting software for your startup. In this article, we will explore the key features of accounting software for startups and provide you with tips on how to choose the right one for your business.

Understanding Accounting Software for Startups Accounting software is designed to help businesses manage their finances, including accounts payable, accounts receivable, payroll, and general ledger. It can also help you generate financial statements and reports, track expenses, and manage your budget. Accounting software can be used by businesses of all sizes, from sole proprietors to large corporations. However, startups have unique needs when it comes to accounting software. They need software that is easy to use, affordable, and scalable as their business grows.

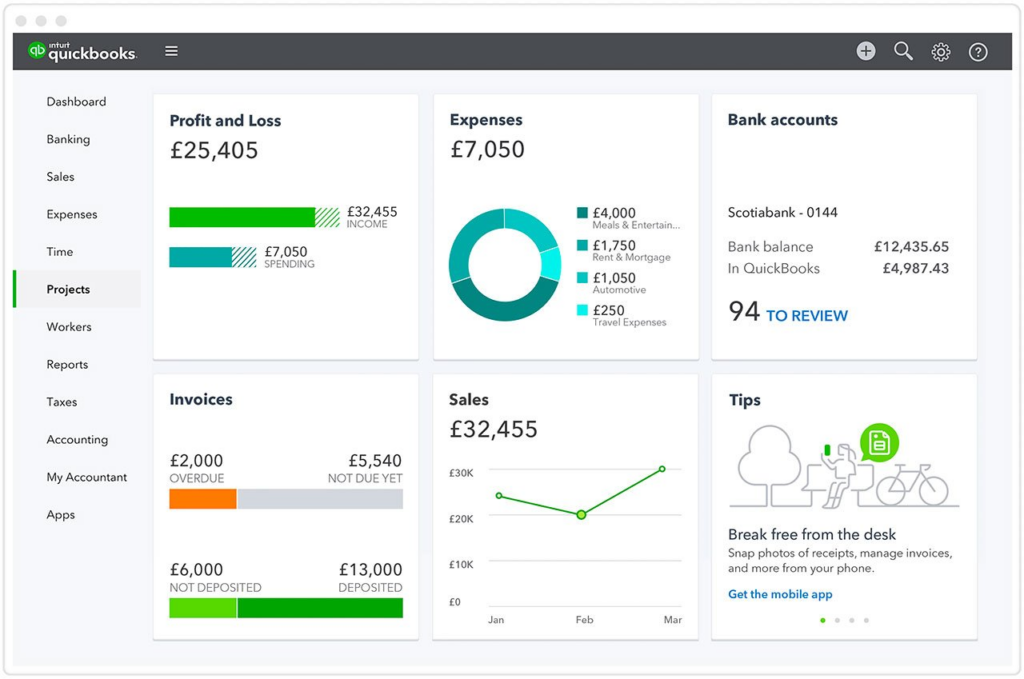

Key Features of Accounting Software When choosing accounting software for your startup, it’s important to look for key features such as invoicing, expense tracking, and financial reporting. Invoicing features allow you to create and send invoices to your customers, while expense tracking features help you keep track of your expenses and categorize them for tax purposes. Financial reporting features allow you to generate financial statements such as income statements and balance sheets, giving you a clear picture of your financial health.

Key Takeaways

- Accounting software can help startups manage their finances more efficiently, saving time and money.

- When choosing accounting software, it’s important to look for key features such as invoicing, expense tracking, and financial reporting.

- Startups need accounting software that is easy to use, affordable, and scalable as their business grows.

Understanding Accounting Software for Startups

As a startup, managing finances is a crucial aspect of running a successful business. Accounting software can help streamline this process, providing a comprehensive system for tracking expenses, generating financial reports, and managing cash flow. In this section, we will discuss the basics of accounting software for startups, including cloud-based accounting software, ease of use, and specific needs.

Accounting Software for Startups

Accounting software is a computer program designed to manage financial transactions, including accounts payable and receivable, payroll, and general ledger entries. For startups, accounting software can be a valuable tool for managing finances, tracking expenses, and generating financial reports.

Cloud-Based Accounting Software for Startups

Cloud-based accounting software is a type of accounting system that allows users to access their financial data from anywhere with an internet connection. This type of software is becoming increasingly popular among startups, as it offers several benefits, including scalability, flexibility, and cost-effectiveness.

Ease of Use

When choosing accounting software for your startup, ease of use is an important factor to consider. Look for software that is intuitive and user-friendly, with a simple interface that makes it easy to navigate and use. This will help ensure that your team can quickly and easily manage finances without the need for extensive training or support.

Specific Needs

Every startup has unique accounting needs, and it’s important to choose accounting software that can meet these needs. Look for software that can handle your specific financial transactions and generate the reports you need to make informed decisions about your business. Consider features such as invoicing, payroll management, and inventory tracking when selecting accounting software for your startup.

In conclusion, accounting software is an essential tool for startups looking to manage finances effectively. When choosing accounting software, consider cloud-based options, ease of use, and specific needs to ensure that you select software that meets your business requirements.

Key Features of Accounting Software for Startups

As a startup, it is important to keep track of your finances and ensure that your accounting process is streamlined. Accounting software can help you manage your finances effectively and efficiently. Here are some key features to look for when choosing accounting software for your startup.

Invoicing and Payments

One of the most important features of accounting software for startups is the ability to create and send invoices. A good accounting software should allow you to create customized invoices that reflect your brand and include all the necessary details such as item descriptions, quantities, and prices. It should also allow you to send invoices directly from the software and track payments. Recurring invoices are also an important feature that can save you time and effort.

Also read: ERP Software Benefits: Streamlining Business Operations

Expense Tracking and Reports

Expense tracking is another important feature of accounting software for startups. It should allow you to easily record expenses and categorize them for tax purposes. It should also allow you to generate reports that give you a clear picture of your business expenses, profits, and losses. Financial reports such as balance sheets and income statements are also important features that can help you make informed business decisions.

Integration and Scalability

Integration and scalability are important factors to consider when choosing accounting software. It should integrate seamlessly with other business tools such as CRM software, payment gateways, and inventory management software. This will ensure that your accounting process is streamlined and all your business tools work together seamlessly. Scalability is also important as your business grows. The software should be able to handle increasing volumes of data and transactions without compromising on performance.

In conclusion, accounting software can help you manage your finances effectively and efficiently. When choosing accounting software for your startup, look for features such as invoicing and payments, expense tracking and reports, and integration and scalability. With the right accounting software, you can focus on growing your business while keeping your finances in check.

Choosing the Right Accounting Software

As a startup, choosing the right accounting software is crucial for the financial health of your business. With so many options available, it can be overwhelming to decide which one to use. In this section, we will discuss the top accounting software options and considerations for startups.

Top Accounting Software Options

Here are some of the top accounting software options for startups:

- QuickBooks: QuickBooks is a popular choice for small businesses. It is user-friendly and offers a range of features, including invoicing, expense tracking, and financial reporting. QuickBooks also offers a free trial to help businesses decide if it is the right fit for them.

- FreshBooks: FreshBooks is another popular option for service-based businesses. It offers time tracking, project management, and invoicing features. FreshBooks also offers a free trial for businesses to test out the software.

- Xero: Xero is a cloud-based accounting software that offers a range of features, including invoicing, expense tracking, and financial reporting. Xero also offers a free trial and is known for its ease of use and scalability.

- Sage: Sage is a more customizable option for businesses with specific needs. It offers a range of features, including invoicing, expense tracking, and financial reporting. Sage also offers a free trial and is known for its scalability.

- Zoho Books: Zoho Books is a cloud-based accounting software that offers invoicing, expense tracking, and financial reporting features. Zoho Books also offers a free trial and is known for its ease of use.

- NetSuite: NetSuite is a more comprehensive option for businesses that need more than just accounting software. It offers features for inventory management, CRM, and e-commerce. NetSuite is known for its scalability and customization options.

- Wave: Wave is a free accounting software that offers invoicing, expense tracking, and financial reporting features. While it may not have as many features as other options, it is a great choice for startups on a budget.

Considerations for Startups

When choosing accounting software for your startup, there are a few considerations to keep in mind:

- Cost: Consider the cost of the software and whether it fits within your budget.

- Free trial: Take advantage of free trials to test out the software and see if it is the right fit for your business.

- Ease of use: Look for software that is easy to use and doesn’t require a lot of training.

- Scalability: Consider whether the software can grow with your business as it expands.

- Customization: Look for software that can be customized to meet your specific needs.

By considering these factors and researching your options, you can choose the right accounting software for your startup and set your business up for financial success.

The Role of Accounting Software in Financial Health

As a startup, managing our finances is essential to ensure our financial health. We need to keep track of our cash flow, income, expenses, balance sheet, profit and loss statement, and other financial records to make informed decisions. This is where accounting software comes in handy.

Accounting software plays a crucial role in maintaining our financial health. It enables us to record, track, and report on our financial information accurately and efficiently. By automating manual tasks such as data entry and report generation, accounting software saves us time and reduces the chances of errors.

One of the significant advantages of using accounting software is its ability to provide real-time financial information. We can access our financial statements from anywhere and at any time. This allows us to make informed decisions quickly and adapt to changes in our financial situation.

Another advantage of accounting software is its ability to streamline our financial processes. We can automate tasks such as invoicing, payment processing, and bank reconciliations. This reduces the time and effort required to manage our finances and allows us to focus on growing our business.

In conclusion, accounting software plays a vital role in maintaining our financial health. It enables us to keep track of our finances accurately, provides real-time financial information, and streamlines our financial processes. By using accounting software, we can make informed decisions quickly and focus on growing our business.

![Best CRM for Commercial Real Estate Brokers in [year] 7 CRM for commercial real estate](https://leoscale.co/wp-content/uploads/2023/11/CRM-real-estate-150x150.png)

![15+ Best AI Background Remover in [year] AI Background Remover](https://leoscale.co/wp-content/uploads/2024/01/AI-Background-Remover-150x150.jpg)

![11+ Best AI Tools for Interview Preparations in [year] AI Interview Preparation](https://leoscale.co/wp-content/uploads/2024/01/AI-Interview-Preparation-150x150.jpg)

![Top 10 AI Tools for Learn Languages You Should Try [year] AI Tools for Learn Languages](https://leoscale.co/wp-content/uploads/2023/12/AI-Tools-for-Learn-Languages-150x150.jpg)

![13 Best AI Search Engines to Try Now in [year] AI Search Engine](https://leoscale.co/wp-content/uploads/2023/12/AI-Search-Engine-150x150.jpg)